It is looking increasingly more likely that 2023 will be a recessionary year. All signs are pointing to recession, if the country isn’t already there yet. And unfortunately, this recession could be a protracted one. Nonetheless, experts recommend that employers hold the line on employee benefits

Employers are all too aware of the fact that inflation drives up prices on nearly everything. While employees are feeling the pinch at the grocery store and gas pump, employers are spending more on everything they purchase to run their businesses. They spend more on employee benefits, too.

Benefits are likely to cost more in 2023. How much more? We can only guess at this point. With inflation continuing to hold steady at historic levels, costs in 2023 could go up substantially. But again, now is not the time to start cutting benefits.

The Job Market Remains Competitive

A big reason to hold the line on benefits is the fact that the job market continues to be competitive. Goldman Sachs’ Kathleen Barber made it clear in a recent interview that employees consider their benefits an important part of their compensation packages. Benefits become more important to them as inflation pinches their bank accounts.

All of this is to say that a strong benefits package becomes an even more important hiring and retention tool in a competitive labor market. If everything else is equal, a strong benefits package gives companies a competitive advantage during times of inflation.

Look at Stronger Voluntary Benefits

Employers should also consider improving their benefit packages where it is practical to do so. A good way to do that during times of inflation is through voluntary benefits. As the brokerage general agency BenefitMall explains, voluntary benefits can be added to a company’s package without adding a ton of expense to the bottom line.

Voluntary benefits are generally paid for entirely by the employee. When employers do contribute, such contributions are minimal. So how does this help employees? By saving them money on services and products that they can get more cheaply through group benefits packages.

Long-term disability insurance is a good example. Consumers can buy the insurance on the individual market and pay top price. When long-term disability is offered through a group benefits package, premiums tend to be lower. Thus, access to the insurance makes for a good voluntary benefit that doesn’t cost the employer a ton of money.

Some Employees Will Have to Cut

Unfortunately, recessionary pressures are bound to take their toll on some employees who ultimately have to cut their benefits. Some simply aren’t going to be able to afford group health insurance any longer. Others will keep their insurance but cut out retirement plan contributions or voluntary benefits.

There is little to be done in this regard. We just need to work through the recession and wait until it passes. With good financial discipline, both employers and employees can utilize strategies that maximize whatever opportunities come along over the next several years.

It Will Eventually Pass

Recession is a normal part of the economic cycle. Recessions come and go. The coming recession predicted for 2023 is no exception. Just like the COVID pandemic, it will eventually pass. Employers would do well to make benefits decisions based on the long-term impact of those decisions rather than looking exclusively at the short-term impact of recession.

Now is not the time to look at cutting employee benefits. With recession on the horizon, experts are recommending that employers hold the line. Even if benefits packages cannot be improved for 2023, employers should hold steady with what they currently offer.

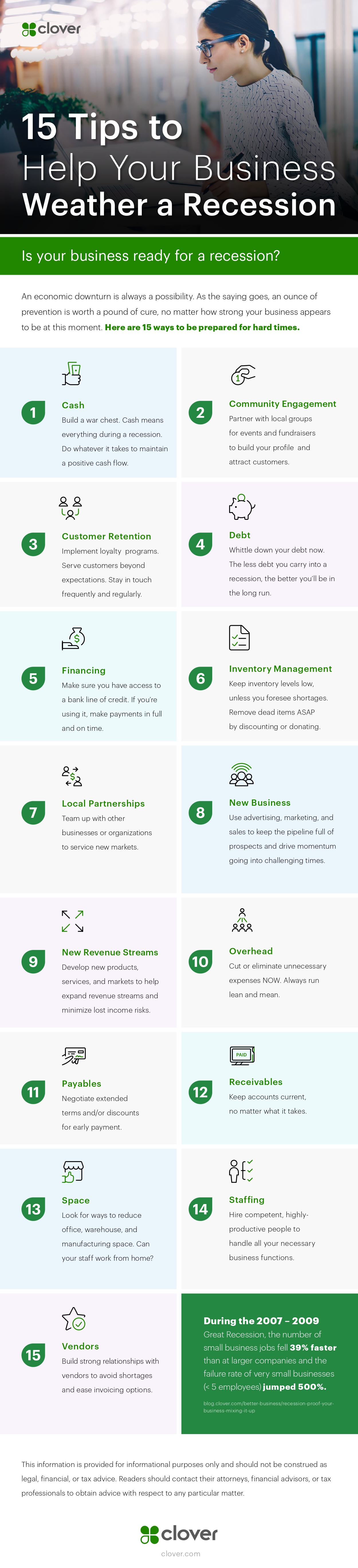

Infographic Created By Clover, Industry-Leading POS Systems and Solutions.